As service tax is always on top in case of revenue collection in Indian GDP upto 50% by the service sector here is some of the notifications about GST effect on Service Sector:

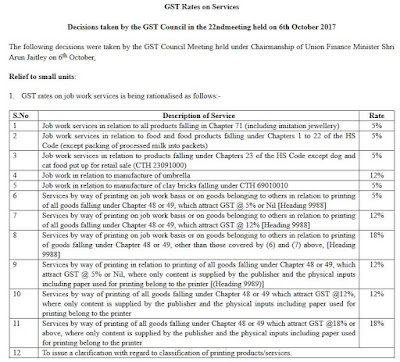

Some of the changes here listed:

No Double Taxation:As on the old tax regime there is a confusion in that whether a particular supply comes under supply of goods or service hence there are both taxes VAT and service tax have to be paid but in GST regime both treated as equally hence only single tax have to pay.

MULTIPLE TAX RATES: As in earlier services there multiple tax taken for particular service but in GST there is only one tax GST only accounted for hence less rate comparison to the previous regime.

MUST BE REGISTERED: As before the registration of service provider firms is not necessary any one can provide services without registration but in GST there must be registered firm only. Those who work with service provider firms also have their GST registration so this makes a chain and registration be necessary now.

सर्विस क्षेत्र पर जीएसटी प्रभाव: सर्वश्रेष्ठ जीएसटी सॉफ़्टवेयर

This regime is beneficial in some aspects but some parts have complications also like now every month must have to fill 3 GST return before it is only yearly, quarterly, or in 6 months. But as the govt. is taking steps in future it will become more and more easier.

Comments

Post a Comment